Have you ever thought about how sports betting winnings should be declared in the Treasury? As you know, in recent years the Government of Spain has seriously analyzed the entire legal mechanism in which this type of product is included. A situation that has forced players to know what the legal framework is that protects them in the event that we have to declare the winnings from sports bets in the Treasury.

Currently we can find a large number of methods that allow us to bet anywhere in the world with our bets. In How to declare your earnings in sports betting to the Treasury as specialists in affiliate marketing in our country, there are many clients that we have who are interested in all the formulas that exist to be able to declare our earnings in sports betting in the Treasury and comply with all current legislation in this regard. The objective is to respect the entire legal framework before which we find ourselves and to be able to continue playing and betting in a simple way, avoiding any possible problem that we may have to face. In this article we teach you how to declare your sports betting earnings to the Treasury. Managing to offer our clients a complete x-ray to understand the scenario in which we find ourselves.

Declare sports betting profits to the Treasury, this is all you need to know

Contenidos

- 1 Declare sports betting profits to the Treasury, this is all you need to know

- 2 When should you declare your sports betting winnings?

- 3 How can I know what is the amount that I must declare?

- 4 The percentage to declare

- 5 What happens if we do not declare our earnings?

- 6 Are welcome bonuses and gifts included?

Declaring earnings on sports betting is one of the first steps you must take in any scenario that we face within this area. For this reason, we must know that the tax regime for sports betting can lead to some confusion in certain aspects. We must take into account all the elements that intervene in this type of space to be able to squeeze the coverage of all the needs that we have.

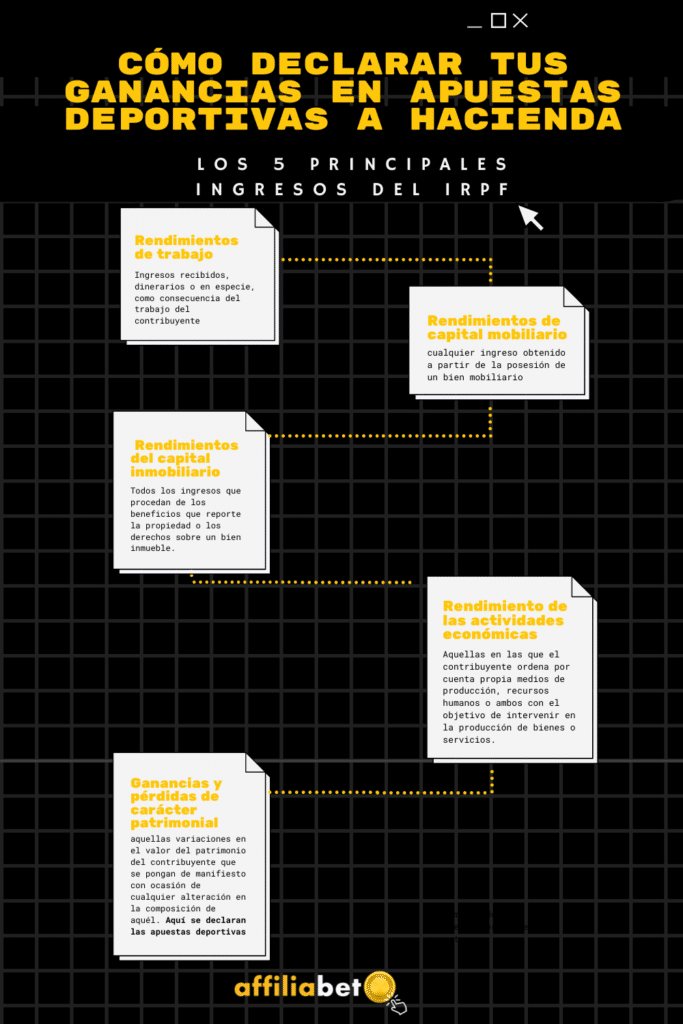

We must remember the importance of one of the most important elements that remain latent in any scenario: personal income tax. This tax is progressive as people residing in Spain receive a greater amount of money. So it is important that we are able to understand that the greater the amount of benefits that we will obtain, the amount of personal income tax that we must address will be greater. Being necessary to take into account all the procedures that exist.

Personal income tax has five main sources of income, despite the lack of knowledge that exists around it: income from work, income from movable capital, income from real estate capital, income from economic activities and profits and losses of a patrimonial nature. It is precisely at this last point that sports betting and other online games come into play. However, it is true that not all people have the obligation to declare them. But it is important that we are able to understand what are the scenarios in which it must be declared.

When should you declare your sports betting winnings?

We must take into account, as we have already mentioned, that not all players must declare all the benefits derived from sports betting. However, there are certain scenarios in which it is necessary to be able to carry out the same. There is a minimum amount for it. These cases in which we must make the declaration are the following:

In the event that we obtain benefits from an online game or other capital gain or capital return that is greater than 1,600 euros.

In the event that we obtain benefits that are greater than 1000 euros. As long as income is received for an amount greater than 22,000 euros or 14,000 euros in the case of having several payers.

Do you want to know some examples?

In the event that we have a job in which we earn 15,000 euros a year and obtain a profit of 1,500 euros in sports betting: In this case, we would not have to declare the earnings.

We work earning 25,000 euros a year and we obtain an income of 900 euros. In this case we will be obliged to declare.

If we work earning 18,000 euros a year and we make a profit of 1,800 in poker. In this case we should also carry out the relevant declaration.

Therefore, and according to what is observed, the scenarios are changing and it is important that we are able to anticipate them in order to squeeze all the needs we have in legal matters.

How can I know what is the amount that I must declare?

The first element that we must take into account is that the winnings of the online game must always be taxed per calendar year. Or, what is the same, by the yields that we have obtained between the first and the last day of the year. In the case of most bookmakers, each player can find a report on the status of their accounts this year in their profile. Despite this, in general terms, it should be taken into account that everything is very easy to account for if we take into account that a simple formula is all we need to be able to have a very approximate control.

The money in the balance as of December 31 must be subtracted from the money in the balance as of January 1. Income must be subtracted from the final result. And to all the previously described formula we must add all the withdrawals.

At the time the income statement is made, we must pay attention to box 290 of the statement. This is where the result of the difference between gains and losses will occur. These are the boxes found in 282 and 287.

In the event that we have doubts about it, it is recommended that we entrust all our needs to the figure of the advisor. In this way, you will be able to review the entire declaration according to the information that we have offered you.

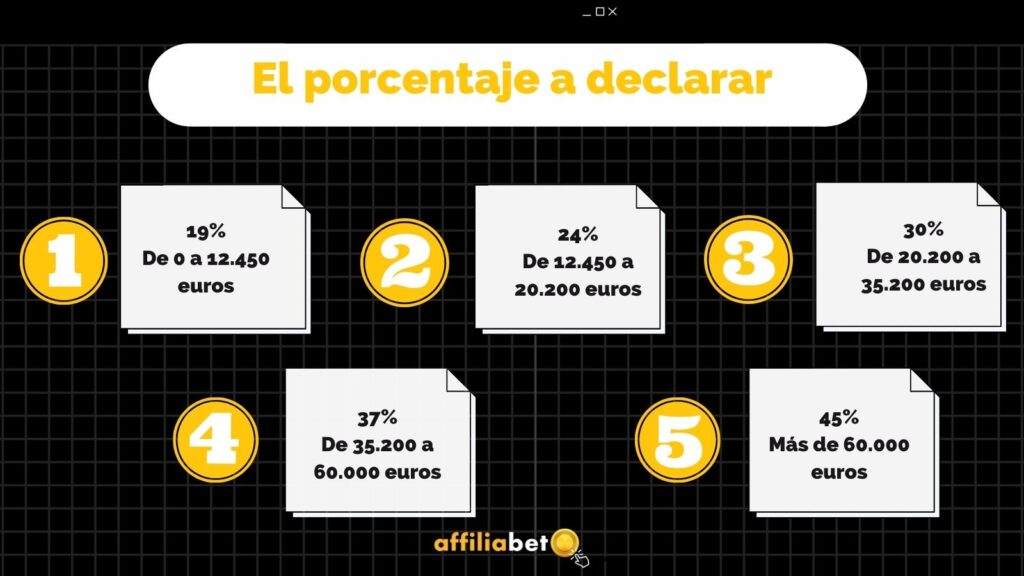

The percentage to declare

Once we have known when we must carry out our declaration, it is time to know exactly the percentage that we must declare. Since this is one of the most common doubts that our clients have. It is important to know that there are different elements that intervene in this regard. However, we have gathered the information in general so that you can find out which regime you should take advantage of in the event that you need to make the relevant declaration.

These are the sections in which we must act:

From 0 to 12,450 euros: 19%

From 12,450 to 20,200 euros: 24%

From 20,200 to 35,200 euros: 30%

From 35,200 to 60,000 euros: 37%

More than 60,000 euros: 45%

At all times we must know that the tax is progressive. Therefore, it must be paid according to each tranche of earnings. It is important to have this value well controlled to know what is the amount of money that we must pay according to our needs.

What happens if we do not declare our earnings?

It is important to keep in mind that at all times there is an obligation to present the winnings that come from the bookmakers and from any online game in which we are playing. Otherwise, it is possible that we expose ourselves to receiving an inspection from the Treasury, since through our data they can control all the movements that we make with our bank account.

In the event that we are penalized, it is important to note that it is ultimately possible to receive a penalty of up to 100% of the winnings. Therefore, it is necessary that we act in accordance with current legislation.

Are welcome bonuses and gifts included?

It is important that we bear in mind that both the welcome bonuses and the rest of the gifts that we can receive from this type of movement must be included in the income statement. Since they do compute with the final amount of money that we obtain from benefits.

For this reason, we must take into account all the income we make, as well as the withdrawals. Any movement is likely to be registered and, therefore, declared. To avoid any possible greater evil that we have to face, we must collect these amounts that we have received as a gift. Otherwise, and as we have previously mentioned, we can reach up to 100% of the fine.

As we have been able to verify, there are many elements on which we must focus our attention when it comes to declaring our earnings on sports bets in the Treasury. It is important that we know what all the elements that intervene in this type of mechanism are in order to obtain the necessary route with which to be able to act respecting the legal framework.

Thanks to the wide variety of options that we currently have, it is important that we are very clear about all the elements involved. At Affiliabet, as the number 1 manager in sports betting in our country, we have all the existing information on everything that refers to sports betting in the Treasury. Trust our services and let yourself be advised by our team of professionals. With them, achieving the best result is easier than ever. Get in touch with us and let yourself be seduced by everything we can offer you. What are you waiting for us to meet?